Avoid paying unnecessary taxes in your retirement accounts.

Avoid paying unnecessary taxes in your retirement accounts.

Figuring out what types of retirement accounts are taxed, and at what rate, can be very confusing.

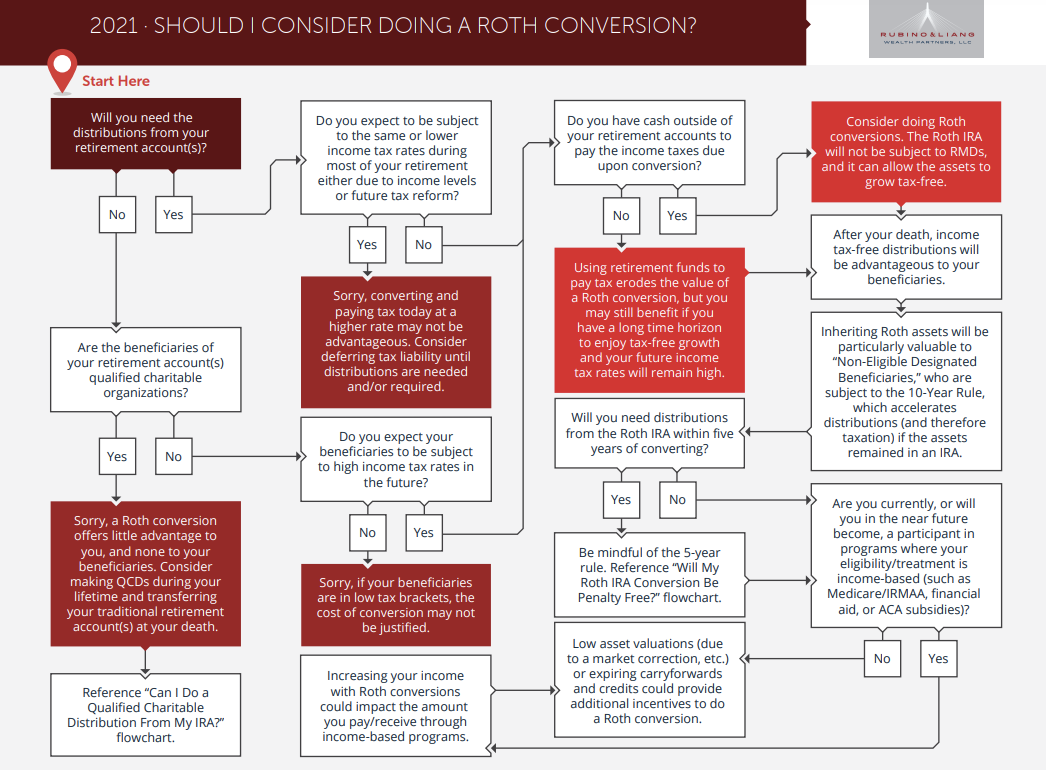

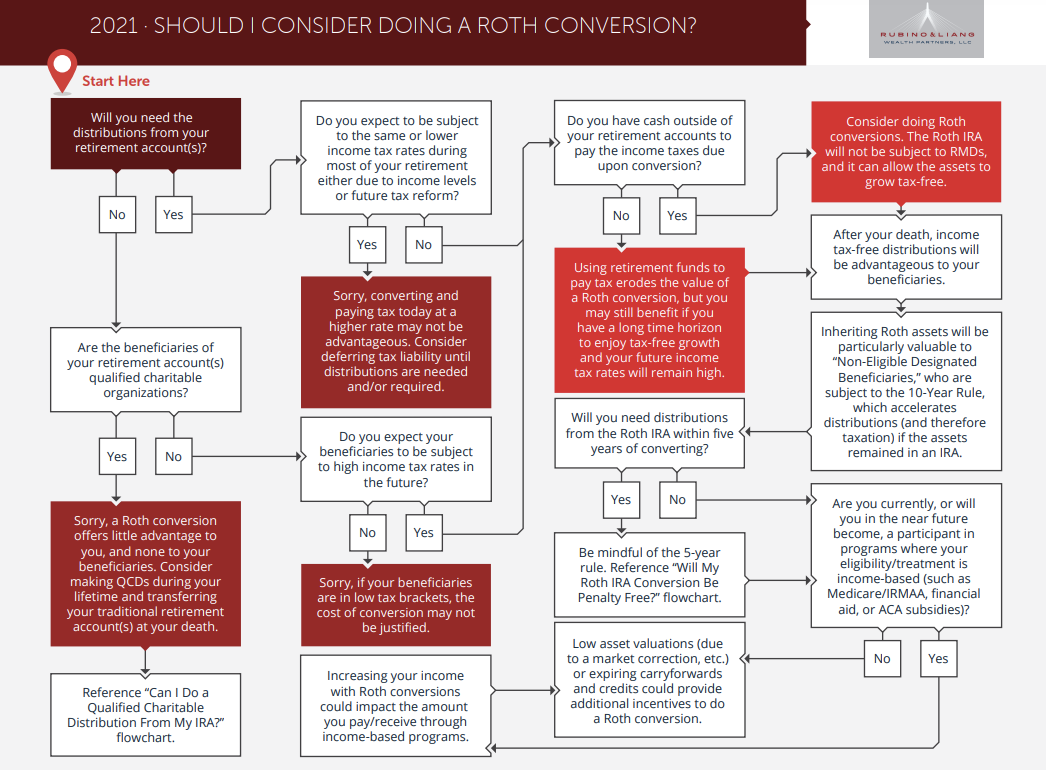

Use this Roth Conversion Flowchart to determine if a Roth Conversion is the right move for you.

There are a lot of important considerations to weigh before doing a Roth conversion. As a result of the current market condition and changes due to the SECURE Act, Roth conversion options are becoming an important conversation that you might want to have with your advisor.

This flowchart addresses some of the major decision points to help guide you through the conversation. This flowchart covers:

- Changes in marginal tax rates for clients (or their heirs)

- Ability to pay the associated tax with cash outside the retirement account

- Five-year rule implications