How Does Withdrawal From Different Types Of Retirement Accounts Effect Your Tax Rate?

In this episode of After The Paycheck, Ryan and Adam discuss:

- Three Ways That Retirement Accounts Are Viewed From A Tax Standpoint

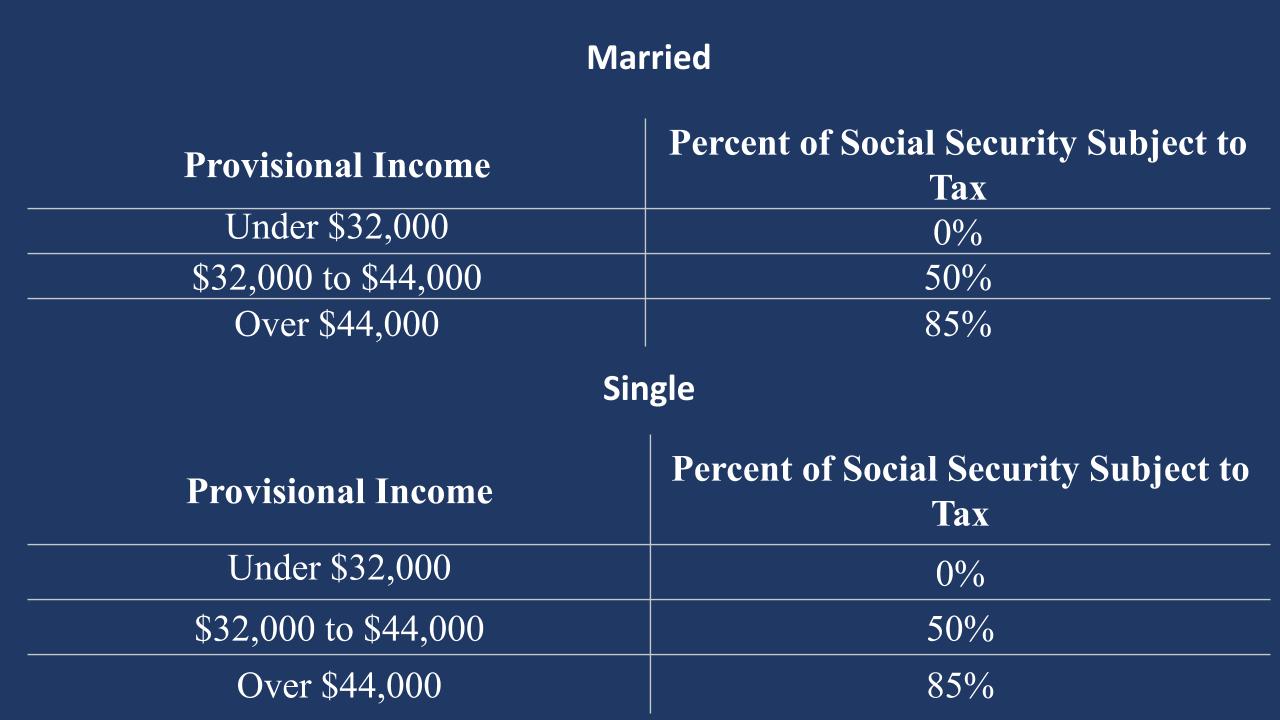

- How Your Retirement Income Withdrawal Plan Can Effect Your Social Security Benefits

- The Difference Between Effective Tax Rate and Marginal Tax Rate

- Options You May Have Before Retiring That Could Help Lower Your Tax Rate In Retirement

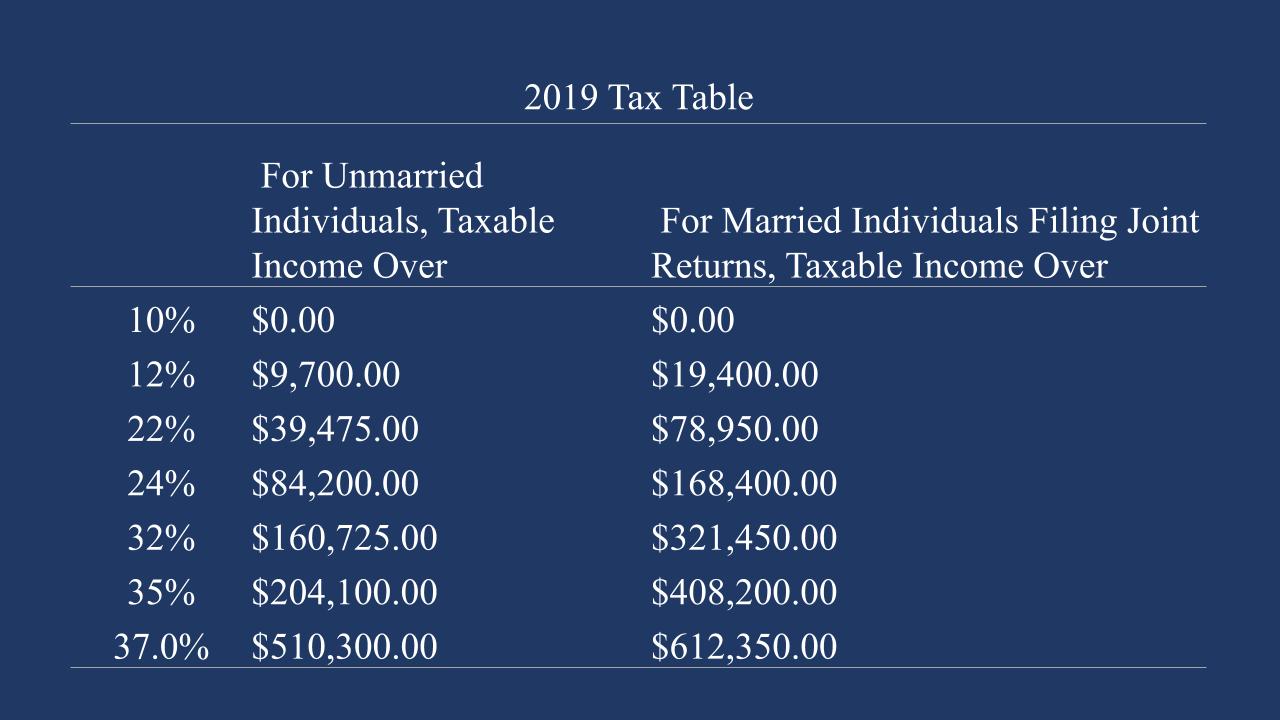

2019 Tax Table:

Action Steps -

- Use Our Monthly Budget Planner To Find Out Your Monthly Income Needs

- Multiple that by 12 to calculate your annual withdrawal needs, and find out where you initially fall in the 2019 tax bracket

- Determine if your Social Security income would be taxed (and at what rate), and if that may effect your retirement longevity and lifestyle expectations.

- Speak with a tax professional to discuss your unique situation before taking any action!

Questions, comments, concerns? Let us know by filling out the form below!