New Laws Could Change IRA Contributions and Withdrawal Rules for High Net Worth Individuals

Congress' Ways and Means Committee recently released the first draft of a major tax bill that could...

A Roth IRA is an after-tax qualified account that encourages you to save for retirement by allowing contributions and earnings to grow tax free. As opposed to a traditional IRA that is funded using before-tax dollars, a Roth IRA is funded using earnings that have already been taxed, offering a tax benefit. This also means that your withdrawals in retirement typically will not be taxed – compared to a traditional IRA, whose withdrawals are taxed as income. Once you’re age 59 ½ and have had a Roth IRA account for five years or longer, any money that you take out including earnings will not be taxable.1

Anyone who meets the income limits and who has earned income from a job can use these after-tax dollars to contribute up to $6,000 (2019) per year to a Roth IRA. Individuals who are age 50 or older with earned income can contribute up to $7,000 per year. One major difference between a traditional IRA and a Roth IRA is that the IRS puts contribution limits on Roth IRAs based on how high your income is.

Unlike a traditional IRA, in which income does not affect the amount you are allowed to contribute, you may only be able to make a partial contribution to your Roth IRA if your modified adjusted gross income (MAGI) is above a certain range.

For example, if you are married filing jointly and earn between $193,000 and $202,999 in 2019, you may only be able to make a partial contribution. And if that value is more than $203,000 per year as a married couple filing jointly, then you may not qualify to open a Roth account.1 There are also limits for individuals filing single status as well as married filing separately.

If you are below the IRS income limits, you can open a Roth account and contribute up to the maximum allowable amount every year. You are allowed 15 months to make a contribution for the current tax year (January 1 to the tax filing deadline of the following year).1

If you are above the IRS income limit, you may still have an option to contribute to a Roth IRA using a method called a “Backdoor Roth.” 2

A “Backdoor Roth” is essentially a conversion of traditional IRA assets into a Roth IRA. Anyone, no matter how much income they make, can convert funds from a traditional IRA to a Roth IRA. And there are currently no limits on how much money can be converted. There are two ways to transfer, or “roll over,” this money. You can make contributions to a traditional IRA and then roll over the money to a Roth IRA account. Or, you can convert your entire existing traditional IRA account into a Roth IRA account.

Please note that any money that you convert from a traditional IRA to a Roth will be taxed up front. However, once you’ve moved the money into a Roth, it will begin to grow tax free.2 It’s also important to note that every individual is eligible to do one Roth conversion per year.

There are many areas to think about in considering a Roth IRA, with taxes being one of the most important. As a general recommendation, if you expect your tax rate to remain the same or increase in the future, then using funds from income that has already been taxed (at the lower rate) to fund a Roth IRA may be a good option.

In this hypothetical example, it may also be beneficial to convert funds from a traditional IRA into a Roth, given the expectation of higher taxes in the future. However, if you expect your tax rate to decrease in the future, it may be better to fund a traditional IRA, thus delaying taxes on the funds until a later date in which the rate will be lower. These are general concepts, where each person’s decision will vary based on their individual circumstances. Work with a qualified professional to look at your specific situation.

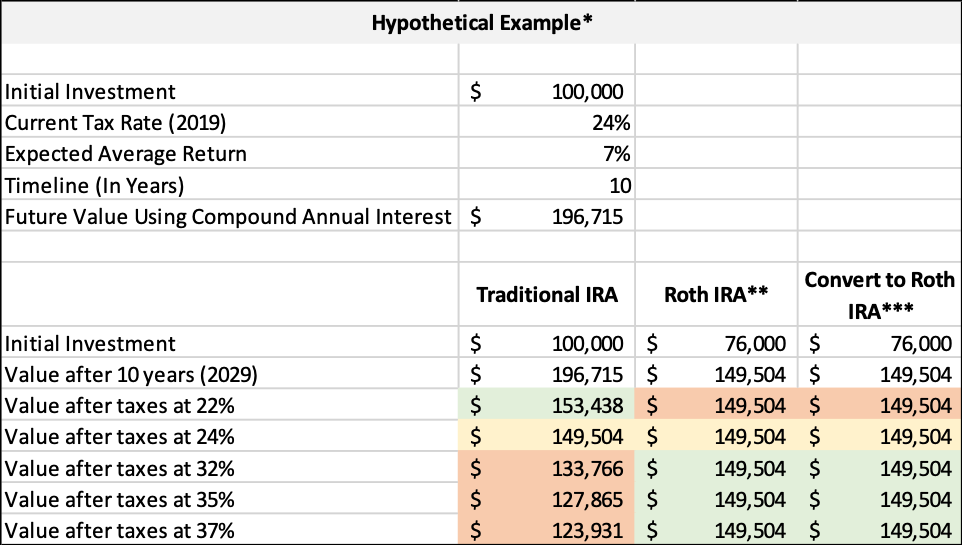

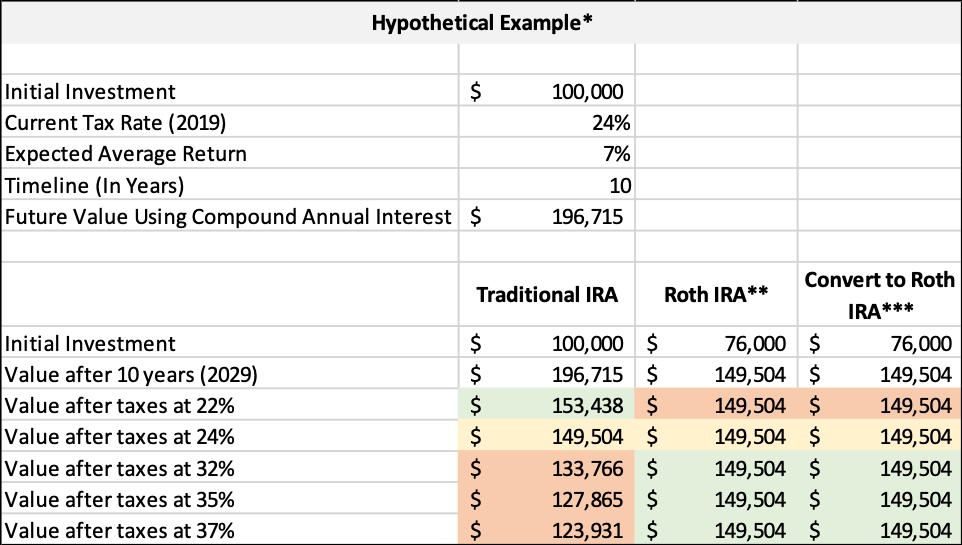

Here is a hypothetical example*:

Let’s assume someone has $100,000 in a traditional IRA account and is currently in a 24% federal/state income tax bracket. Hypothetically, let’s expect they will experience an average return of 7% annually over the next 10 years.3

If they don’t convert, the $100,000 would grow to $196,715 after 10 years. If the full amount is withdrawn at the 24% tax rate, the client would have $149,504 left after tax.3

If they do convert, the $100,000 would be taxed now at 24%, which leaves $76,000 for investment opportunities. The $76,000 could grow to $149,504 after 10 years, and the whole amount would be tax-free.3

*This hypothetical illustration does not represent any actual investment performance, price, or yield. The annual compounding is being used for this hypothetical illustration only. Investment returns are not guaranteed, and your actual return may vary significantly from that shown. Your agent or representative may not give tax advice. Please consult your tax advisor to discuss your individual circumstances.

**Roth IRA original value uses earned income that has already been taxed.

***Roth Conversion from a traditional IRA to a Roth IRA creates a taxable event as the contributions are now included as earned income and taxed at the ordinary income tax rate. Note that this transfer could potentially push you into a higher tax bracket.

So, if you believe taxes have the potential to increase or stay the same going forward, then you might want to consider working with a professional to see if a Roth conversion is right for you. After 10 years, if the tax rate goes above 24% in this hypothetical example, then the client would have less money from the traditional IRA and more money from the Roth.3

Still unsure if a Roth IRA is the right move for your particular situation? Book a time to chat with us and go over your unique situation. Just as no two people are alike, we believe no two retirement plans should be, either. So make sure that you speak with a professional who understands your retirement planning needs.

Sources:

You’ve set aside money all of these years, hoping to have a fluffy nest for retirement. You’ve...

What's the hardest lesson you've ever had to learn about money?