Six Action Items To Help You Prepare For A Solid Retirement

You’ve made it to that magical time in your life – the home stretch to retirement. Whether you...

By: RL Wealth Partners Dec 7, 2023 12:05:46 PM

$100 is on the table, and you have a choice.

You can choose to receive $50 or flip a coin. If you choose the coin toss and get heads, you get $100. If it’s tails, you get nothing.

What do you do?

If you’re like most folks, you’re probably going to take the $50. It’s a sure thing.

Now, what if this were a game of losses?

What if you stood to lose $50 out of the gate?

And what if the coin toss meant losing $100 with heads or losing nothing with tails?

What would you do then?

Here, most folks choose to flip the coin.

And even though they’re making a different decision — flipping the coin and taking the risk, instead of going with the known option — their reasoning hasn’t really changed. In both cases, the choice is largely based on fear, the fear of losses.1

That fear is natural.2

So is a related emotion, greed.3

In fact, fear and greed are behind a lot of our financial choices and, often, not the best ones.4

It doesn’t matter if the markets are bullish or bearish…greed and fear can easily creep in and disrupt our ability to make sound, long-term decisions.

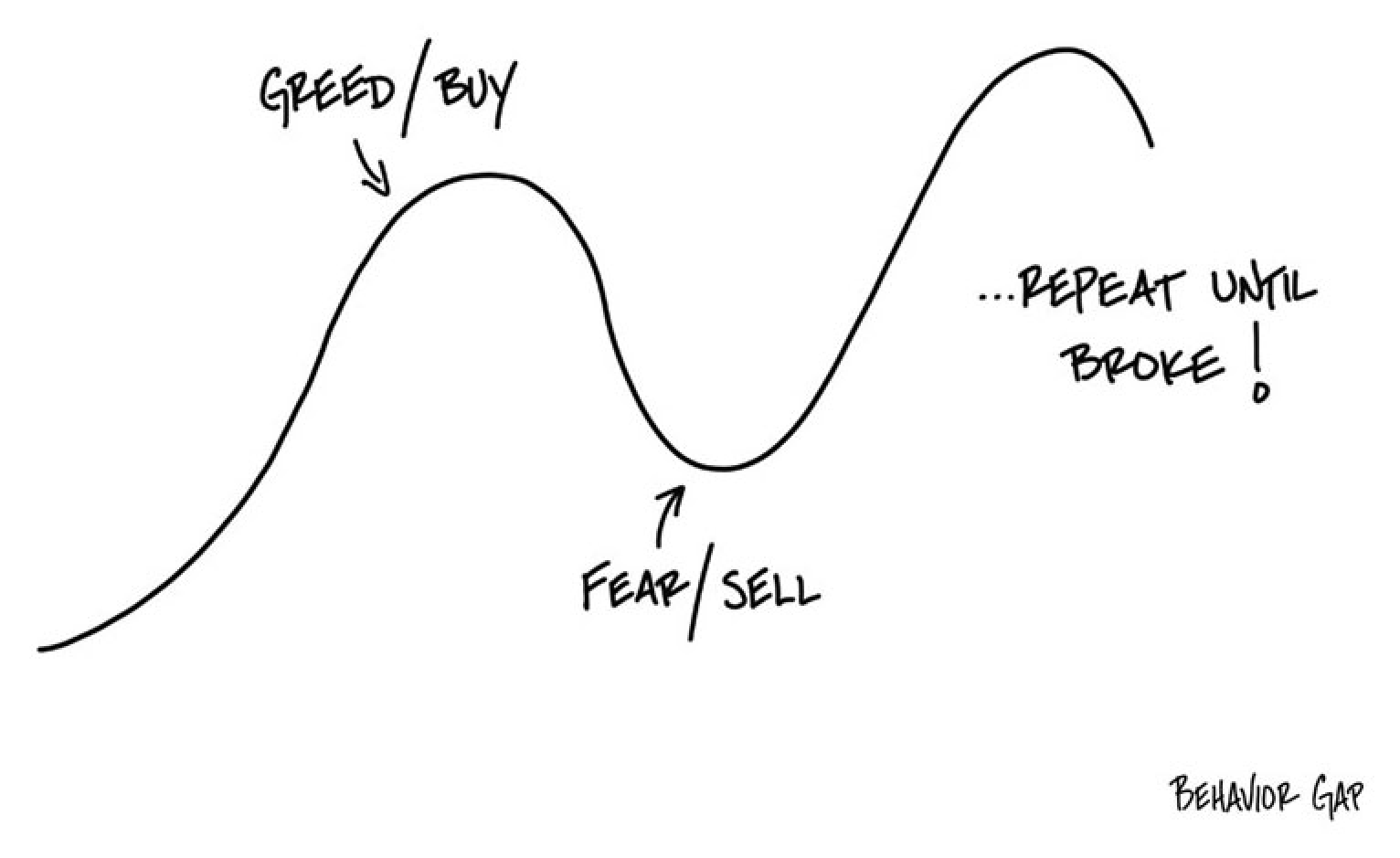

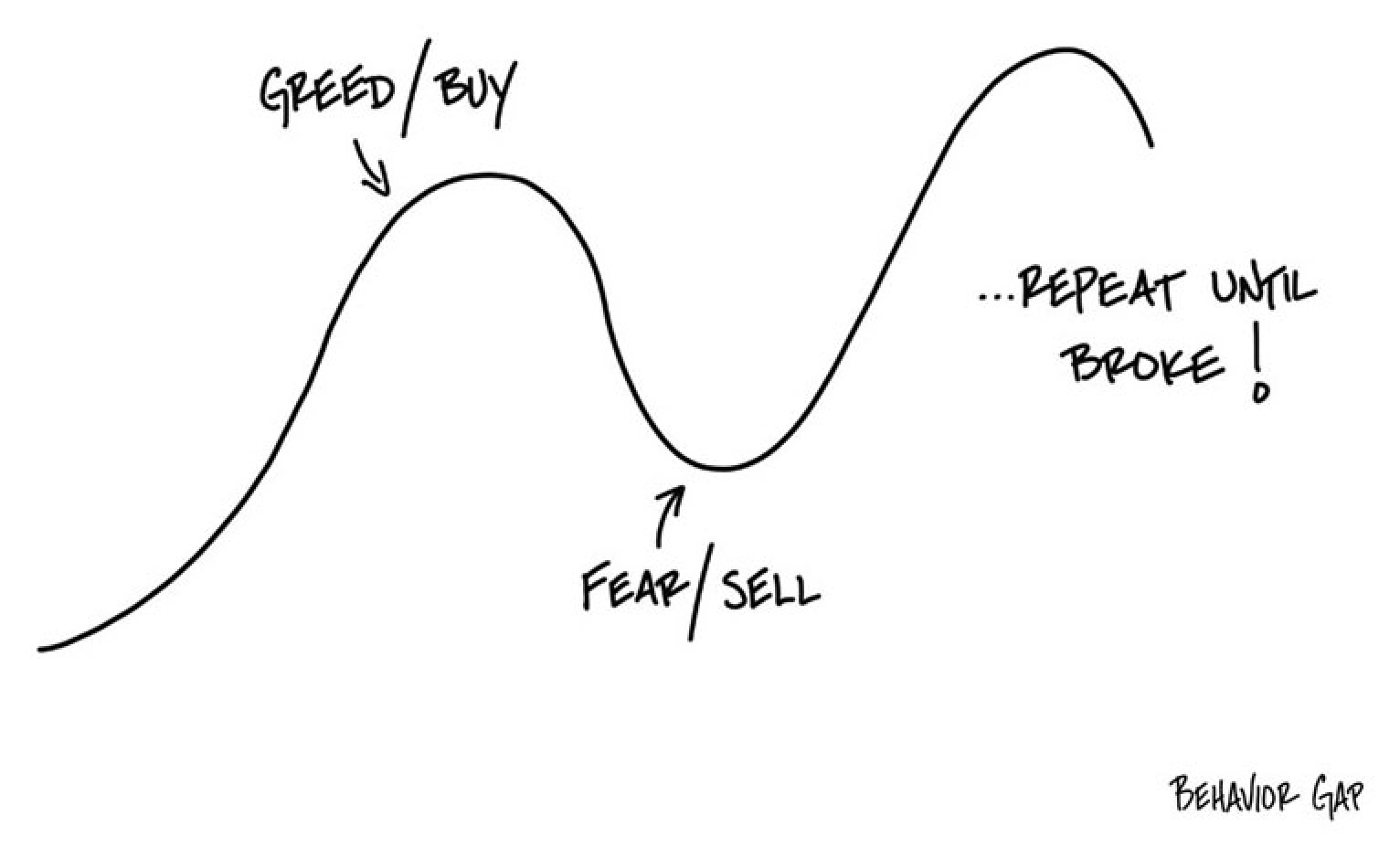

That’s how we lose big — and how we get in the cycle of buy high, sell low, and lose BIG.5

The illustration below basically sums up the mistakes we make with our money over and over.

Let’s take a look at the greed/fear cycle by walking through some key moments when mass fear and greed put markets and investors in a tailspin:

|

1987 Stock Market Crash (Black Monday) |

When: Monday, Oct. 19, 1987

Why: PANIC! Wall Street melted down, giving into fear in response to major world events. A U.S. attack on an Iranian oil platform caused a massive panic, with fear driving many to sell ASAP. Markets crashed soon after.6

The Losses: The Dow dropped ~22.6%, falling 508 points. That’s roughly the same as a 7,000-point freefall in today’s markets.7

The Dotcom

|

|

When: ~1995 to ~2002, with a peak on March 10, 2000, and a crash on Oct. 4, 2002

Why: Extreme optimism in the early Internet age sparked overconfidence, widespread speculation, and overvaluations. Folks gave into GREED, rushing to invest in companies and concepts before they had proven models or finished products. Some didn’t even have business plans. That lasted for years until the bubble burst in late 2002, as investment dollars dried up and many tech companies went under. When the bubble burst, greed turned into FEAR as investors rushed to get out.8

The Losses: The Nasdaq fell nearly 77%, dropping from roughly 5,132.52 (in March 2000) to 1,139.90 by Oct. 2002. Tech companies that didn’t go under saw their values decline by as much as 80%.8 All said and done, the burst of the dotcom bubble resulted in losses of around $5 trillion.9

|

2008 Financial Crisis (The Great Recession) |

When: 2007 to 2009

Why: Cheap credit and new banking laws ushered in a new era of GREED, along with a sharp rise in subprime mortgages. That created a new “housing bubble” that ballooned as banks, insurance companies, and others merged into “too-big-to-fail” entities. The bubble burst, however, with greed once again turning into fear, as many rushed to get out fast, losing BIG in the process. When interest rates rose, borrowers defaulted and housing prices plummeted. That set off a cycle of FEAR and painful losses for hedge funds, lenders, and many others.10

The Losses: U.S. households lost ~26% of their net worth or roughly $17 trillion in inflation-adjusted terms. Roughly 7.5 million jobs were lost in a matter of two years. A decade after this crisis, experts say the economy shrunk by ~7%, translating to about $70,000 per American.10

2010 Flash Crash |

|

When: May 6, 2010

Why: The market was highly volatile, starting low and tumbling with Greek market fluctuations and elections in the UK. The market took a nosedive, however, with a massive automatic sell order.11 That caused PANIC and a near-contagious level of fear, with rumors of cyberattacks rampant. By the end of the day, the markets recovered about half of the total value lost.12

The Losses: About $1 trillion in market value disappeared in the 2010 Flash Crash.11 During the height of the Flash Crash, approximately $56 billion traded hands in merely 20 minutes.12

|

|

Cryptocurrency Bubble & Bust |

When: ~2020 to ~2022

Why: Crypto has been through a couple of bubbles and busts. The most recent one happened during the pandemic, with GREED gripping many folks out of work and bored at home. That’s when optimism and crypto GREED was high, with many rushing to buy the newest blockchain assets available, including nonfungible tokens (NFTs). Some of these assets appreciated by 20 to 40 times their original value, stoking investor GREED. But it didn’t last. Rising interest rates, inflation, and world events, like the war in Ukraine, soon turned that greed into fear. That fear led into a crypto crash in late 2022, with incredible losses to follow. Once again, greed, fear, and panic caused sharp losses for many.13

The Losses: An estimated $2 trillion was lost so far in the most recent crypto crash. Most of that disappeared in about 6 months.13

Let's look at a simple example: Someone invests a lump sum of $10,000 in the S&P 500 in January 1987. Assuming an average annual return of 10.11% over the next 35 years, that $10,000 lump sum would have grown to about $320,694 by the end of 2022.14

That's a total return of over 3,100% on the initial $10,000 investment.14

Takeaway: This shows the significant compound growth possible from a lump sum investment left untouched for decades.

Of course, staying invested through many ups and downs requires patience and discipline. But the long-term rewards can be substantial with a buy-and-hold approach.

Consider the following investment approach: Investing $500 per month in the S&P 500 from 1987 through 2022.

That's a total investment of $210,000 over 35 years.

Assuming an average annual return of 10.11%, those monthly $500 contributions would have grown to around $1.7 million by the end of 2022.15

That's a cumulative return of over 700% on the total $210,000 invested over decades.15

Takeaway: This example illustrates the power of consistent investing over long time periods.

By sticking to a regular contribution plan, one can potentially build substantial wealth through compounding growth, even if investing relatively small amounts.

The key is to stay disciplined and keep investing through ups and downs.

Whether or not you’ve had a front seat to market booms or busts, the reality is any of us can get anxious, afraid, or even greedy with sudden shocks and surprises in the markets.

How to Nurture Better Financial Instincts & Mute the Pull of Greed & Fear

Were you surprised to see the losses caused by greed and fear?

What do you think you’ve lost or avoided losing in these bubbles, busts, and crises?

If you could go back in time and handle any of them differently, would you?

Whether or not you’ve had a front seat to market booms or busts, the reality is any of us can get anxious, afraid, or even greedy with sudden shocks and surprises in the markets.16

That’s true for even the smartest folks who know the most about finance.

After all, we have to deal with some uncertainty when we’re in the markets.

No one can predict what’s going to happen next, and that can be a tipping point for fear and greed, especially in turbulent times.

With that fear and greed, we tend to be more impulsive. We may even panic and rush to act because we’re afraid of missing out (FOMO, anyone?).

That’s when we can be more vulnerable to poor choices and the losses that we’re so desperate to avoid, like selling low and buying high.

And that can set off a cycle of loss that keeps our long-term goals out of reach.17

But it doesn’t have to.

The more we know about fear, greed, loss, and our financial choices, the better.

That’s how we can get our emotions and instincts in check to make better financial decisions, regardless of what the markets are doing.

(Of course, that’s not always easy to remember in the moment.)

That’s why we shouldn’t jump on any bandwagons or dive into big financial choices without thinking them through.

Instead, take a few simple steps to avoid the fear/greed cycle and do the following:

It’s prudent to check in with the folks we trust, especially when it’s time to make major money moves.

As financial professionals, we've seen how folks panic, make impulsive moves, and look back with regret.

We've also had the opportunity to help many folks recognize their greed and fear, overcome it, and make more prudent choices to support their long-term objectives. and we'd be honored to do the same for you.

Sources:

https://www.investopedia.com/articles/02/112502.asp

https://www.mayoclinic.org/healthy-lifestyle/stress-management/in-depth/stress/art-20046037

https://www.sciencedirect.com/science/article/pii/S2352250X22000355

https://cxl.com/blog/fear-and-greed/

https://www.investopedia.com/articles/01/030701.asp

https://www.britannica.com/topic/Black-Monday

https://www.cnn.com/2022/10/19/investing/premarket-trading-stocks/index.html

https://www.investopedia.com/terms/d/dotcom-bubble.asp

https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/dotcom-bubble/

https://www.britannica.com/money/topic/financial-crisis-of-2007-2008

https://corporatefinanceinstitute.com/resources/equities/2010-flash-crash/

https://www.theguardian.com/business/2015/apr/22/2010-flash-crash-new-york-stock-exchange-unfolded

https://www.theguardian.com/technology/2022/jun/29/crypto-crisis-digital-currencies-boom-collapse-bitcoin-terra

https://www.officialdata.org/us/stocks/s-p-500/1987?amount=10000&endYear=2022

https://www.officialdata.org/us/stocks/s-p-500/1987?amount=210000&endYear=2022&dcaPeriod=420#dollar-cost-average

https://www.cnbc.com/select/tips-to-avoid-emotion-based-investing-younger-investors/

https://www.investopedia.com/articles/basics/10/how-to-avoid-emotional-investing.asp

You’ve made it to that magical time in your life – the home stretch to retirement. Whether you...

While inflation has been cooling off from the craziness we saw in 2021 and 2022, it is still well...

What’s your goal, financially speaking, for retirement? Most likely, its to make sure you have...