Currently, those who are age 50 and older can make catch-up contributions in their 401(k) accounts each year, with eligible workers allowed to put an extra $7,500 into their accounts, for a total of $30,000, this year.

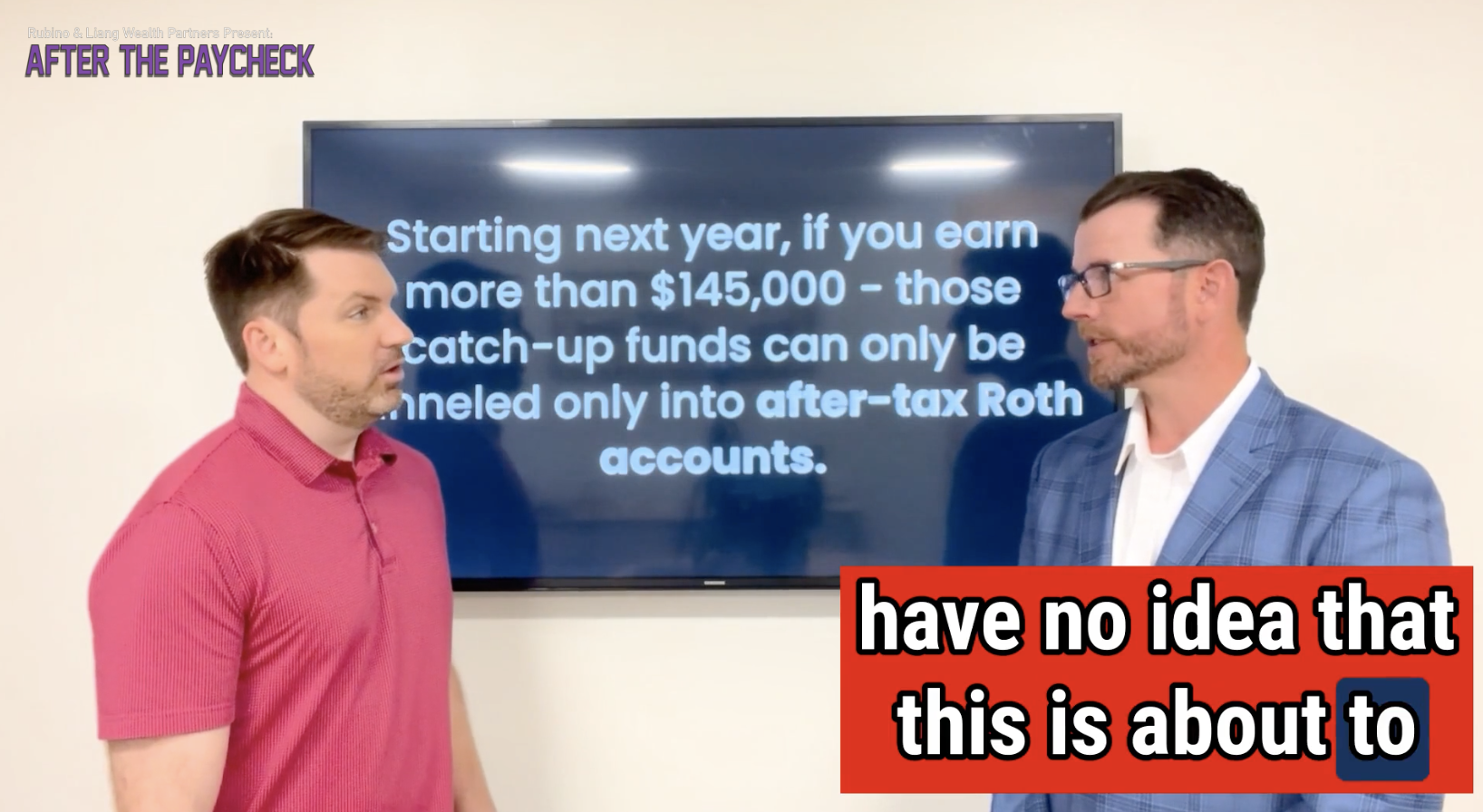

Starting next year, if you earn more than $145,000 - those catch-up funds can only be funneled only into after-tax Roth accounts.

The change is part of a set of new rules Congress passed back in December.

This change may mean you will pay taxes on your catch-up money up front during your working years, rather than in retirement when you may be in a lower tax bracket.

A big advantage to the catch-up contributions was the ability to lower your taxes owed for the year you made that money - For example, someone in a 35% bracket would receive a $2,625 tax deduction for a $7,500 catch-up contribution, while someone in the 22% bracket would deduct $1,650.

So, how might this new set of rules affect your current retirement planning situation?

In this video, Ryan Marston goes over how this may affect your current retirement planning strategy, especially if you are currently working but hoping to retire in the next five years.